Welcome back to The Interchange! If you want this in your inbox, sign up here. We’re back after a brief hiatus, with lots of fintech news, including Robinhood’s latest acquisition, Plaid’s newest product and a ChatGPT-powered AI tool that aims to help you save money on bills.

Robinhood’s motives

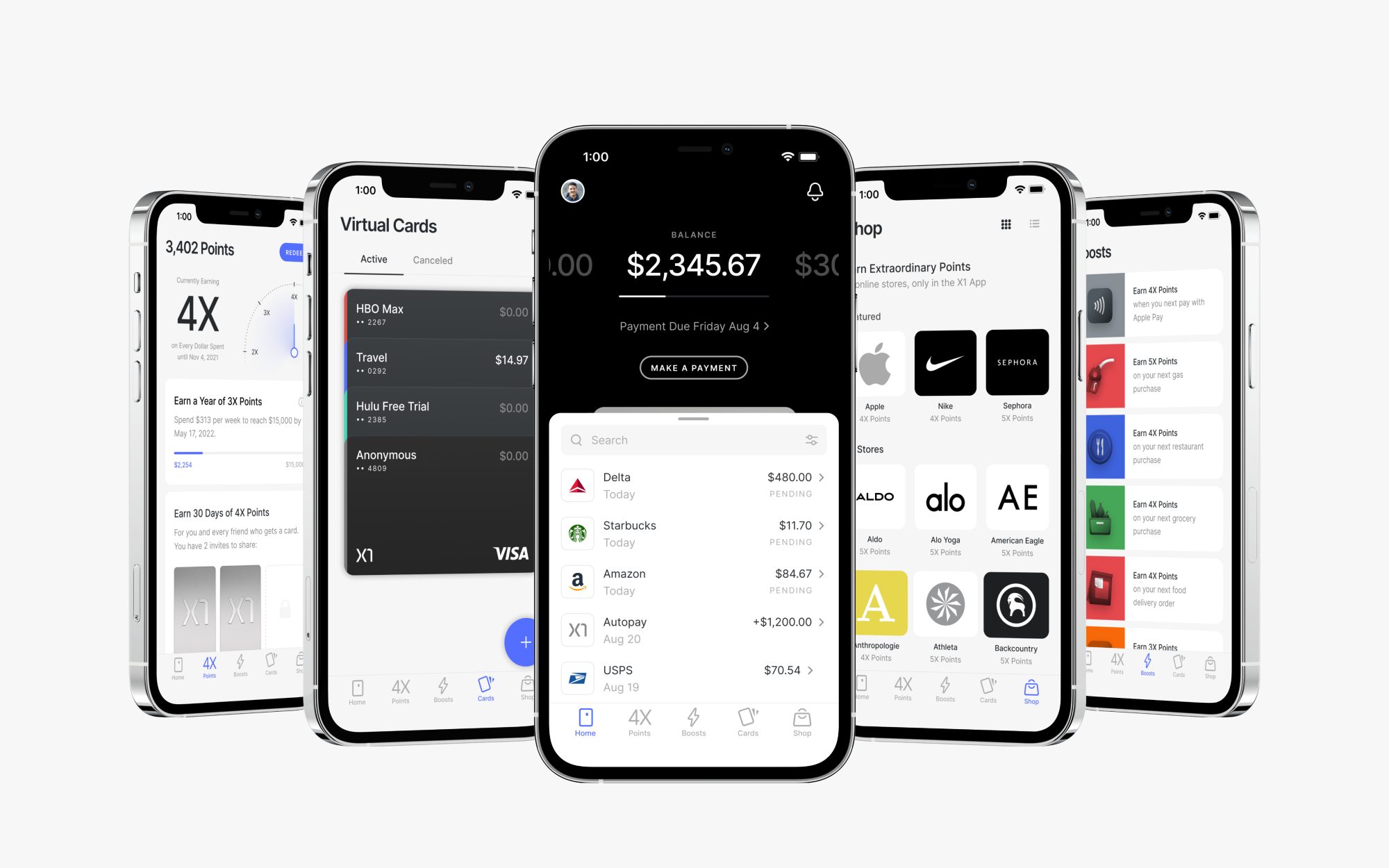

When Robinhood announced on June 22 that it was acquiring credit card startup X1 for $95 million, it caused all sorts of chatter in the fintech world.

Why would Robinhood want to buy a credit card startup? Did it get a good deal, considering that X1 has raised only $62 million over its lifetime? Did its investors get a good deal or just a return on their investment? Why X1 in particular over the many other credit card startups out there?

Let’s talk about that last point first.

When we talked to X1 in December at the time of its last fundraise, founder and CEO Deepak Rao told us the company was launching a new trading platform that would give its cardholders the ability to buy stocks by using earned reward points. He even singled out Robinhood as a company he was hoping to compete with, telling TechCrunch: “By using credit card points to buy stock instead of cash or their savings, we feel this is a safe way for many consumers to start investing. There is no real downside as their investing is technically free.”

Aha.

Could that be what drew Robinhood to X1??

On this week’s Equity podcast, we chatted about that possibility, with co-host Alex Wilhelm noting that one would have to earn a lot of rewards before being able to buy many stocks. He also pointed out that Robinhood perhaps had some money to burn, as well as the company declaring that it was looking for something new as a way of “broadening [its] product offerings” and “deepening” its relationship with existing customers.

If you’ve been following Robinhood’s performance over the past year, a desire to diversify its business is probably not a surprise. We noted that not only has Robinhood’s crypto trading slowed, but also the company has seen significant user attrition. So an X1 acquisition gets Robinhood into the credit card space and an additional revenue stream.

Still, one observer noted that while X1’s basic premise of offering credit based on income rather than credit score was innovative, since it first formed in 2020 it has not really since delivered anything — other than the new stock feature — that stands out in the market.

Fintech analyst Alex Johnson shared a similar sentiment, tweeting: “The brand alignment is strong. Both companies have a certain unearned machismo about them. Other than that though, I don’t get this for Robinhood. X1 doesn’t have a lot of customers (did it ever even fully launch?) and none of its features are revolutionary.”

It is true that X1 may not have had a lot of customers, especially in comparison to a giant like Robinhood, but the company claimed to be on a growth trajectory, with Rao telling us last December that the company saw $3 million a month in revenue last October, giving it an annual revenue rate of $36 million.

Not everyone is down on the deal, though. Better Tomorrow Ventures’ Sheel Mohnot tweeted that while X1 may not have a lot of customers, Robinhood does. He added: “[T]his seems like a good acquisition to me, cheaper to cross-sell than to sell to new customers.”

— Mary Ann and Christine

![X1, a challenger credit card startup, gets 50% valuation boost as it plans to launch an investing platform]()

Image Credits: X1

Weekly News

Fintech startup Plaid got its start as a company that connects consumer bank accounts to financial applications but has since been gradually expanding its offerings to offer more of a full-stack onboarding experience. And on June 22, Plaid announced even more new product releases that moved the company into a whole new direction while also helping to diversify its revenue streams. At the top of that lies Beacon, which it is describing as a “collaborative anti-fraud network enabling financial institutions and fintech companies to share critical fraud intelligence via API across Plaid.” More here.

Navan (formerly TripActions) offers both a corporate card and a subscription to its software. In a twist, the company announced on June 12 the launch of a new product called Navan Connect, which it describes as a patented card-link technology that gives businesses a way to offer automated expense management and reconciliation without having to change their corporate card provider. For the initial launch, Navan has partnered with Mastercard and Visa, with plans to announce additional network tie-ups in the near future. More here.

Spend management startup Brex was named to Time’s 100 Most Influential Companies list. As it made the recognition, Time wrote: “Co-CEO Henrique Dubugras says think of Brex as a ‘spend platform.’ The company launched its corporate charge card for startups five years ago, and has since grown into a fintech conqueror. Valued at $12.3 billion in 2022, it has made 10 acquisitions, and after Silicon Valley Bank’s collapse, it received $2 billion in deposits and opened 4,000 new accounts. Last year Brex launched Empower, software that links Brex cards and accounts to a custom expense-management service. The company services startups, helping new businesses get off the ground, as well as enterprise clients, including DoorDash, Indeed, Coinbase, SeatGeek, and Lemonade.” Ramp, another spend management startup, also made the list, with Time writing: “Notching an $8.1 billion valuation just three years after being founded is striking, even for a tech startup. While many fintech companies struggled last year, Ramp’s meteoric rise accelerated. The business-expense-software firm saw revenues quadruple as its customers looked to stay lean through inflation. Ramp’s Visa cards are tied to employer-set policies, so employees instantly know if charges are approved; reports and receipts aren’t always needed. Employers get alerts about duplicate expenses and items they may be overpaying for. ”

Brubank, an Argentina-based digital bank founded by former Citibank executive Juan Bruchou, shared with TechCrunch that since launching in 2019, it has brought in nearly 3 million clients, making Brubank “the largest Spanish-speaking digital bank in Latin America, with a 50% activity rate,” according to the company. It also has been sustaining bottom line profitability for the past 12 months.

At least two companies are poised for a credit card launch this summer: Snowfoll, one of three startups that pitched at TC Early Stage Boston in April, will launch a credit card in July that is tailored to users in the U.S. and India so they can more easily transmit cash cross-border. The company said users in the U.S. are eligible for limits as high as $30,000, and the card reduces the need for having separate bank accounts in the U.S. and India. In addition, the process is instant and cost-free. Meanwhile, Step, the financial platform tailored to teens, their families and young adults, opened up a waitlist for its latest card, Step Black Card. Cardholders will be eligible for perks, including earning 5% on savings balances up to $1 million and up to 8x the points on purchases. Read TechCrunch coverage on Step here and here.

Other headlines

This ChatGPT-powered AI tool can help you haggle to save money on bills

PayEm integrates spend management and procurement platform with American Express

Stripe launches payments for bookings in Google Calendar

Transactions: Citizens selects embedded payments provider Wisetack

Amsterdam’s fintech unicorn Adyen partners with Shopify to strengthen its commerce capabilities

Visa launches fintech accelerator in Africa

TTV Capital continues buildout with hiring of ex-Global Payments CFO

Funding and M&A

Seen on TechCrunch

Volt, an open banking fintech for payments and more, raises $60M at a $350M+ valuation

Heard Technologies grabs another $15M to develop therapist accounting tools

Nasdaq to acquire financial services software company Adenza from Thoma Bravo for $10.5B

With Equifax in its sights, TransUnion invests $24M in income verification platform Truework

Finfra lets Indonesian businesses add embedded finance to their platform

And elsewhere

Dallas-based Yendo raises $24M in Series A funding

Fintech firm Rho in talks to buy startup formerly known as Party Round

Car-insurance firm Root gets takeover bid (Interestingly, the company’s stock got a big boost when the news came out, spiking from an opening price of $5.92 per share to close at $12.62 that day.)

Neo-lender Gulp Data secures $25m, bringing data-backed loans to startups

Alternativ raises $10 million as digitally native RIAs pick up steam

Fortis expands to Canada, adds fee collection feature, acquires SmartPay

![]() Join us at TechCrunch Disrupt 2023 in San Francisco this September as we explore the impact of fintech on our world today. New this year, we will have a whole day dedicated to all things fintech, featuring some of today’s leading fintech figures. Save up to $600 when you buy your pass now through August 11, and save 15% on top of that with promo code INTERCHANGE. Learn more.

Join us at TechCrunch Disrupt 2023 in San Francisco this September as we explore the impact of fintech on our world today. New this year, we will have a whole day dedicated to all things fintech, featuring some of today’s leading fintech figures. Save up to $600 when you buy your pass now through August 11, and save 15% on top of that with promo code INTERCHANGE. Learn more.

![]()

Image Credits: Bryce Durbin

Did this one feature entice Robinhood to acquire X1? by Christine Hall originally published on TechCrunch

Join us at TechCrunch Disrupt 2023 in San Francisco this September as we explore the impact of fintech on our world today. New this year, we will have a whole day dedicated to all things fintech, featuring some of today’s leading fintech figures. Save up to $600 when you buy your pass now through August 11, and save 15% on top of that with promo code INTERCHANGE.

Join us at TechCrunch Disrupt 2023 in San Francisco this September as we explore the impact of fintech on our world today. New this year, we will have a whole day dedicated to all things fintech, featuring some of today’s leading fintech figures. Save up to $600 when you buy your pass now through August 11, and save 15% on top of that with promo code INTERCHANGE.